Various Dutch Mortgages for Expats

Types of Dutch Mortgages for Expats – Explained Clearly

If you are buying a home in the Netherlands as an expat, choosing the right mortgage type is just as important as finding the right property. The Dutch mortgage system offers several options, but only two mortgage types are most commonly used by expats and eligible for mortgage interest tax deduction.

At Expat Mortgage Platform, we explain all mortgage options in clear English and help you select the structure that best fits your income, lifestyle, and long-term plans.

Not sure which mortgage suits you?

Get personalised advice in a free consultation.

Dutch Mortgage Types for Expats

In the Netherlands, the two most common mortgage types are:

Annuity mortgage (Annuïteitenhypotheek)

Linear mortgage (Lineaire hypotheek)

These are currently the only mortgage types eligible for the mortgage interest tax deduction (renteaftrek) for new mortgages.

Choosing between them has a major impact on:

Monthly payments

Total interest paid

Tax benefits

Long-term affordability

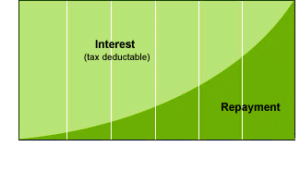

Annuity Mortgage (Annuïteitenhypotheek)

With an annuity mortgage, you pay the same gross monthly amount throughout the entire mortgage term (usually 30 years).

How it works:

In the early years, payments consist mainly of interest

Over time, the interest portion decreases

The repayment portion increases gradually

Advantages for expats:

Lower monthly payments at the start

Higher interest portion initially → more tax deduction

Popular choice for first-time buyers and expats expecting income growth

Disadvantages:

You pay more total interest over the full mortgage term

Slower debt reduction compared to a linear mortgage

Want to see your monthly payments?

Use our mortgage calculator to estimate your annuity mortgage.

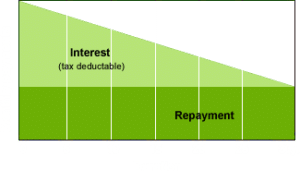

Linear Mortgage (Lineaire Hypotheek)

With a linear mortgage, you repay a fixed amount of principal every month, plus interest on the remaining debt.

How it works:

Monthly payments are highest at the beginning

Interest decreases as the debt is repaid

Total monthly costs decrease over time

Advantages for expats:

You repay your mortgage faster

Lower total interest costs compared to an annuity mortgage

Strong long-term financial position

Disadvantages:

Higher monthly payments at the start

Less tax advantage in the early years due to lower interest

This mortgage is often suitable for expats with higher starting income or those planning for long-term stability in the Netherlands.

Annuity vs Linear Mortgage – Which Is Better for Expats?

There is no “one-size-fits-all” answer. The right choice depends on:

Your current income

Expected salary growth

Length of stay in the Netherlands

Risk tolerance

Tax situation

| Factor | Annuity Mortgage | Linear Mortgage |

|---|---|---|

| Monthly payments | Lower at start | Higher at start |

| Total interest | Higher | Lower |

| Debt reduction | Slower | Faster |

| Tax benefit early years | Higher | Lower |

We often help expats combine mortgage types or structure them strategically.

What About Interest-Only Mortgages?

For new mortgages, interest-only mortgages are no longer eligible for mortgage interest tax deduction.

However:

If you had an interest-only mortgage before 2013

You may still be eligible to use it again under certain conditions

This is a complex area with strict rules.

Have an older mortgage or special situation?

Contact us for tailored advice.

How Much Can I Borrow as an Expat?

Your borrowing capacity depends on:

Income

Employment contract

Existing debts

Property value

In the Netherlands, you can finance up to 100% of the market value of the property.

Calculate your maximum mortgage in just a few clicks.

How Can Expat Mortgage Platform Help?

We help expats:

Compare all Dutch mortgage types

Choose the most tax-efficient structure

Understand long-term financial consequences

Secure the best possible interest rate

Our advice is 100% independent and tailored to expats.

Best Mortgage advice for Expats

The Expat Mortgage Platform experts will help you find the perfect Mortgage against the best possible rate! Calculate your Maximum Expat Mortgage online or make a free appointment with one of our mortgage advisors. Welcome!