To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.

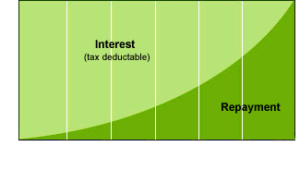

With an annuities mortgage (annuiteiten hypotheek) you will pay the same amount over the whole period of the mortgage. In the beginning, this will mainly consist of in-terest and only a small part of the loan. Gradually this changes so that at the end of the mortgage you will mainly repay your loan. With an annuities mortgage you usually have lower monthly payments in the early years of the mortgage period than a linear mortgage. The high amount of interest can be deducted on taxes, which makes your net monthly cost low in the beginning of the mortgage. The downside of an annuities mortgage is that you will pay more interest compared to a linear mortgage.

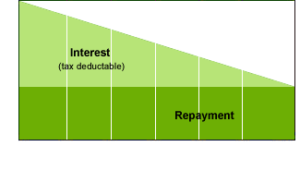

With an annuities mortgage (annuiteiten hypotheek) you will pay the same amount over the whole period of the mortgage. In the beginning, this will mainly consist of in-terest and only a small part of the loan. Gradually this changes so that at the end of the mortgage you will mainly repay your loan. With an annuities mortgage you usually have lower monthly payments in the early years of the mortgage period than a linear mortgage. The high amount of interest can be deducted on taxes, which makes your net monthly cost low in the beginning of the mortgage. The downside of an annuities mortgage is that you will pay more interest compared to a linear mortgage. With linear Dutch mortgages (lineaire hypotheek) is the amount of debt that you repay the same every month. On top of the debt you will also pay interest, which will be the highest in the beginning of the mortgage as there is not a lot of loan that is paid back yet. Your debt is reduced every month which also reduces the interest. At the beginning of a linear mortgage the costs are high, but they will gradually decrease. With a linear mortgage you can pay off your mortgage as quickly as possible. Another advantage of a linear mortgage is that you pay less debt compared to an annuities mortgage. The downside of this mortgage is that you pay a high amount in the beginning of the mortgage.

With linear Dutch mortgages (lineaire hypotheek) is the amount of debt that you repay the same every month. On top of the debt you will also pay interest, which will be the highest in the beginning of the mortgage as there is not a lot of loan that is paid back yet. Your debt is reduced every month which also reduces the interest. At the beginning of a linear mortgage the costs are high, but they will gradually decrease. With a linear mortgage you can pay off your mortgage as quickly as possible. Another advantage of a linear mortgage is that you pay less debt compared to an annuities mortgage. The downside of this mortgage is that you pay a high amount in the beginning of the mortgage.